Weekly News 045

Contents:

1. LG Electronics to Unveil Line of EV Charging Stations in U.S.

2. Asustek to build a server production line in the U.S. to tap the AI boom.

3. Microsoft introduces its own chips for AI using TSMC 5nm processes.

4. Boat, Noise drive growth in the Indian wearable market.

5. CN Semiconductor Production Equipment Imports Surge 93% YoY in Value.

1. LG Electronics to Unveil Line of EV Charging Stations in U.S.

LG Electronics, which started its EV charging business in 2018, has enhanced its competition in the sector after acquiring HiEV, a Korean EV charging pile maker, in 2022. LG Electronics will enter the rapidly growing U.S. electric vehicle charger market in 2024 with the introduction of its first line of AC- and DC-powered EV charging stations, including 11kW and fast charging up to 175kW of charging stations, the company disclosed. LG Electronics is set to expand its commercial and long-distance charging pile product line in the second half of next year to meet the mounting demand in the U.S.

Comment:

A rise in electric vehicles sharply elevates the need for charging, which has the potential to spread. The launch of charging posts in the U.S. market next year is part of LG Electronics' strategy to enter the fast-growing EV charging segment.

2. Asustek to build a server production line in the U.S. to tap the AI boom.

Asustek Computer Inc. is planning to set up a production line in the United States, with mass production scheduled for 2024.

ASUS is strengthening its minicomputer and smart manufacturing businesses, while the firm set a goal to ramp up its server sector by 500% in five years at the beginning of the year in the face of the slump in the entire consumer electronics and the bump of artificial intelligence.

Simultaneously, the company built another new factory in Taoyuan, Taiwan of China to produce mainboards, graphic cards, minicomputers, and servers, which will start to run in 2024.

Comment:

The "embedded or industrial computing market" for factory automation is anticipated to maintain climbing at an average of 15% per year. This is one of the critical reasons why ASUS recently signed a technology license agreement to acquire and merge Intel's NUC computing business, manufacturing, and product design with its minicomputer division.

3. Microsoft introduces its own chips for AI using TSMC 5nm processes.

At its annual Ignite conference on November 15, Microsoft unveiled two customized chips for artificial intelligence (AI) and cloud computing: the Azure Maia AI accelerator and the Azure Cobalt CPU designed on the Arm architecture, both of which will be fabricated by TSMC using 5nm manufacturing technology. Microsoft has also established new partnerships with NVIDIA and Supermicro.

Comment:

Microsoft's cloud service sales surged last quarter, boosted by demand for artificial intelligence. Microsoft seeks to sell AI services in the cloud, with its longer-term goal of operating AI services on PCs and cell phones instead of replacing the AI-chip titans like NVIDIA through this release of new AI chips.

4. Boat, Noise drive growth in the Indian wearable market.

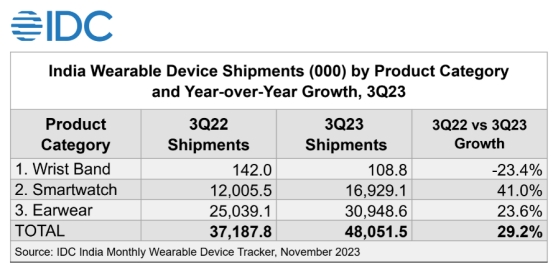

The wearable market in India has experienced significant growth, with a 29.2% YoY increase in Q3 2023. A total of 48.1 million units were shipped, surpassing the 100.1 million units shipped in 2022.

Smartwatches have emerged as the fastest-growing category, with 41.0% YoY growth, while the smart ring category has gained attention from consumers. Earwear saw a YoY growth of 23.6%, shipping 30.9 million units, but its market share dropped to 64.4%. Within the earwear market, Truly Wireless Stereo (TWS) dominated with a 68.4% share, which grew by 46.7% YoY. However, neck bands declined by 6.9% YoY.

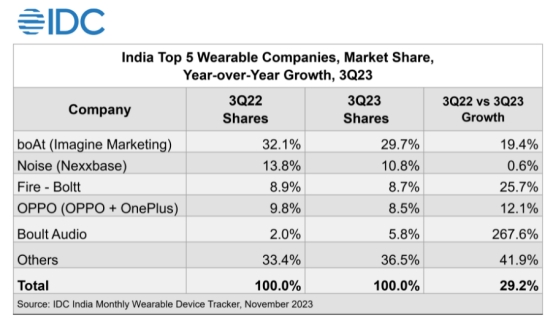

The top five wearable companies in Q3 2023: Boat, Noise, Fire-Boltt, OPPO, and Boult Audio. Boat leads with a 29.7% share; Noise is second with a 10.8% share.

Comment:

With new product releases, Q4 shipments are likely to ascend further. 2024 is expected to see technologies such as UI/UX localization, internal app integration, SIM-based calling, and smartwatch wifi connectivity.

5. CN Semiconductor Production Equipment Imports Surge 93% YoY in Value.

The value of China's semiconductor production equipment imports jumped 93% YoY to RMB63.4 billion in the last quarter. To be specific, the imports of equipment used in core lithography processes hiked nearly four-fold.

The value of lithography equipment imported by China from the Netherlands surged more than six-fold, most of which came from the world's most advanced chip equipment supplier ASML. In addition, China's imports of chip production equipment from Japan, including photolithography and etching machines, rose by about 40% YoY in the last quarter. China's imports of chip production equipment from the US rose by only about 20% YoY in the last quarter.

Comment:

The amount of semiconductor equipment imported into China continues to grow rapidly, especially from ASML, although the US tightened exports of chip production equipment to China in October last year, Japan and the Netherlands followed suit. This indicates the increasing demand for semiconductor equipment in the Chinese market.